|

On March 1, 2016 Thirteenth International Conference "Polyethylene 2016" was held by INVENTRA (a part of CREON Group)

In his welcoming speech Sergey Stolyarov, Managing Director of CREON Group, said that PE Russian market is doing well on the basis of the year in review. In spite of falling oil prices, economy and the exchange rate production survived and also increased to 9% for the year. The decline in consumption amounted to only 1%, which is an excellent result for a year of crisis. Mr. Stolyarov pointed out that segments dynamics was different: the films partially replaced imported products and showed some increase, and the tubes showed some decrease due to the fall in final demand. However, there is a certain "raw material" background, which gives hope for the restoration of the pipe segment.

The conference was opened by the survey paper on PE- market in Russia and the CIS introduced by Lola Ogrel, Director of Analytical Department, INVENTRA. It the end of 2015 the production of polyethylene in the CIS amounted to 1.95 MT, which is 6% higher than in 2014. The consumption amounted to 2.37 MT, 75% of which was the consumption in Russia. As for the other CIS countries, excluding the Russian Federation, Ukraine is the largest consumer (35% of the total volume), followed by Uzbekistan, Kazakhstan and Belarus with shares less than 20% each.

As for the end of 2015, 122 KT of PE was produced in Belarus. 80% of the product is exported, mainly to Russia and Ukraine. The share of imports in consumption reached 93% by the end of the year.

In 2015 Uzbekistan produced 125 KT of PE; however, in 2016 a significant increase in production is predicted. The reason is the launch of HDPE-plant with capacity of 387 KT at Ustyurt Gas and Chemical Complex in December last year. The company's products will be exported. Now domestic consumption is for 90% satisfied by the national enterprise, Shurtan Gas and Chemical Complex.

In 2015 PE consumption in Ukraine decreased significantly, amounting to 210 KT, and was fully satisfied by imported products (the main suppliers were Russia and Saudi Arabia).

In Azerbaijan, on the background of the consecutive two-year growing production (more than 100 KT) consumption is gradually reducing. In 2015, it amounted to 42 KT, which is 2 times less than in 2012.

The same was in Kazakhstan, only 98 KT of consumption in 2015. Local production was not available; the demand was met entirely through imports, accordingly.

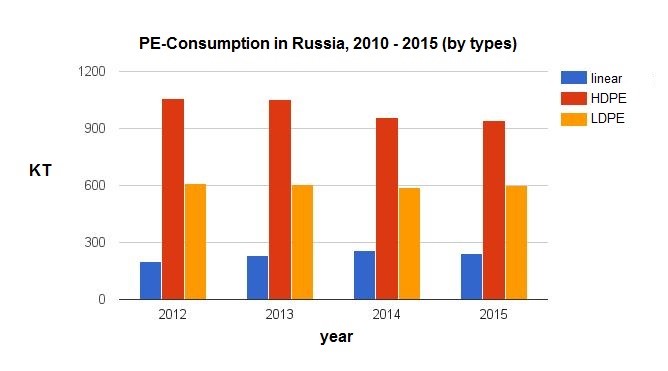

In 2015 PE consumption in Russia decreased slightly, by 1.2% (against 4.5% a year earlier). Ms. Ogrel noted that pipe sector was strongly influenced, by 90 KT to 290 KT. Decrease was noted in the production of cable compounds, which was recovered by the growth of imports. Positive dynamics was noted in the film segment - an increase in demand of 80 KT by reducing imports of the finished package from abroad.

In 2015 export of polyethylene from Russia amounted to 300 KT, which was almost the same as in 2014. The expert noted that not all Russian manufacturers are focused on foreign markets.

Priority directions of Russian export are Kazakhstan and China (almost 50% of deliveries).

In 2015 PE imports to Russia decreased to 483 KT compared to 644 KT a year earlier. According to Ms. Ogrel, this was caused by currency fluctuations and rising domestic production. Major suppliers were Saudi Arabia, Belarus, Germany, South Korea (54% of deliveries).

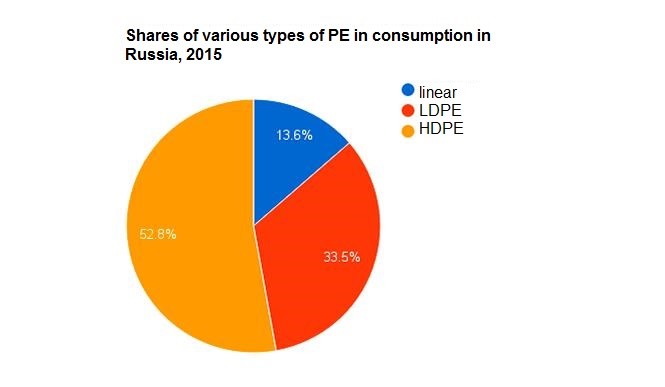

In the last year in overall imports volume the largest share was for a linear polyethylene (200 KT), 174 KT of HDPE and 109 KT of LDPE were imported. Such high volumes of LLDPE imports were due to the fact that domestic production could not meet the growing demand from the film manufacturers. Nowadays, LLDPE market in Russia remains scarce.

According to other speakers, at the end of 2015 LDPE production in Russia amounted to 642 KT, consumption amounted to 574 KT. In 2016 market balance is expected to be approximately the same. A small rebalancing between consumption segments is only possible. The greatest risk is the potential decline in the retail business and industrial packaging.

The main application of LDPE is general-purpose films (61%), 27% are shrink films, by 6% for cable grades, extrusion coating and injection and blow molding.

At the end of 2015 the segment of pipe polyethylene of the Russian market showed very disappointing results decreasing by 25%. If we consider the totality of the markets of Russia, Ukraine, Belarus and Kazakhstan (RUBK), the market contraction was slightly less, namely, 19%. Three development scenarios are provided for Russia and RUBK, namely, positive, negative and consensus forecast. The consensus forecast for Russia is further decrease by 10%, for RUBK the decrease rate will be about 5%. However, in 2016 production of pipe grades of PE for RUBK should show a positive trend. If in 2015 it amounted to about 180 KT, then this year it is expected to reach 240 KT. Imports and exports will remain the same as the last year level. The consumption will continue to decrease and is likely to amount slightly more than 350 KT.

As for Russia, the experts expect that in 2016 the volume of production and consumption of pipe grades of PE will be equal and amount to 240 KT. Imports will continue to decrease and will not exceed 25 KT.

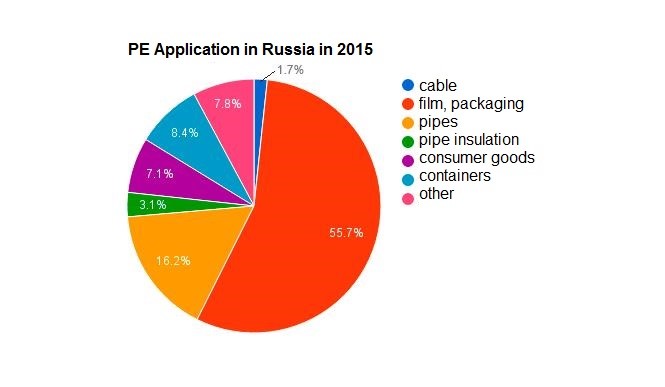

DPO "Plastik" is a major player in the market of modern packaging materials; it widely uses polyethylene in the production. According Denis Dikin, Sales and Marketing Director, PE is used in the company for production of multilayer barrier films and dairy films, extrusion net, boxes and containers. In the structure of PE consumption in Russia the films take the major part (51%), 21% are for pipes, and 8% for boxes and containers.

PE-packaging has a number of advantages; among them are the mechanical strength, chemical resistance, impermeability and attractive appearance. Import substitution is gradually becoming a driver of demand growth for PE-packaging. Consumption of domestic products packaged in domestic packaging is increasing. In addition, there is a trend of transition from general-purpose films to films with specific properties. There is a growing demand for multi-layer films with high barrier properties (that is caused by the need to increase the shelf life). Also, food manufacturers are increasingly moving to the film in order to reduce the packaging costs.

During the conference recycling of polymers was also discussed, which is becoming increasingly important year by year. This is partially due to the stiffening of environmental legislation, and also to the rising costs of raw materials. Certainly, the basic material for recycling is PET; however, polyethylene is also good enough for collection and recycling. In 2015, the volume of solid waste in Russia amounted to 63 MT, 8% of which were plastics. The major share of plastics in the waste volume is a packaging film (35%) and other packaging (42%).However, in terms of extraction they are much behind PET - 20% and 24%, respectively, versus 42% for recycled PET (the proportion of various polymers in the total volume of useful fractions extracted from the volume of solid waste). The main source of recycled LDPE is commercial waste. The recycled PE market is dominated by store-bought films, 120 KT in 2015, which is 49% of the total volume. They are followed by clean industrial waste (22%), and landfill PE, 21% for LDPE and 8% for HDPE.

Further application of recycled PE depends mostly on the location it was collected. So-called clean waste, commercial and industrial, is used for the production of roofing insulation, building hardware, non-food films, some types of tubes. Landfill PE is used for the production of geogrids and geomembranes, boxes and drainage pipes.

At the conference one of the experts presented a paper on biopolymers, the product, which is actively developing not only in Russia but also in Europe. At the end of 2015, Russian biopolymers market did not exceed 10% of the total plastic production, and this market is driven by compostable and bio-based materials only. In Europe, the figure was 25% in the last year and will grow to 42% by 2017 (for comparison, in the Russian Federation it will not be higher than 20%). The speaker noted that biodegradable packaging is already used in the EU.

World production of polymers by the end of 2014 amounted to 1.7 MT, in 2015 it was already 2 MT, and by 2019 it will reach 7.8 MT. The product can be used in many areas, among them - pellets, films, packaging, and agricultural products.

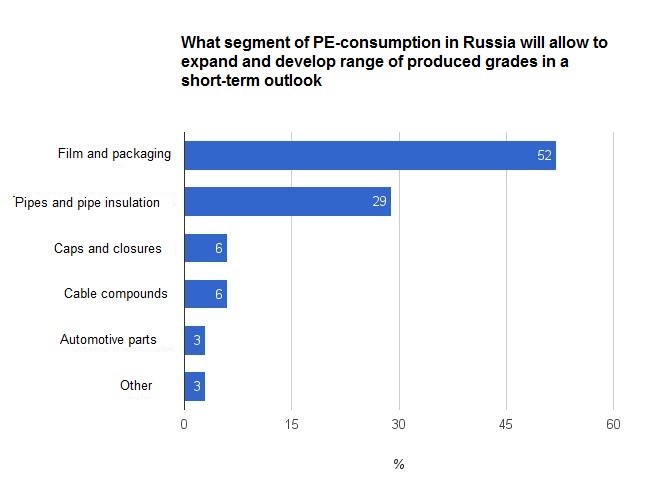

Delegates of the conference took part in the interactive voting on the development prospects of domestic consumption. To the question “What segment of PE-consumption in Russian will allow to expand and develop the range of produced grades in a short-term outlook” the most portion of replies were films and packaging (52%).

To summarize the results of the discussions, Sergey Stolyarov, Managing Director of CREON Group, said: "From the viewpoint of supply of raw materials, shortage on PE-market has been overcome in two of the three segments; and the production of linear PE is multiply increasing. Prevailing conditions allow Russian plants to expand the range of grades and perform overhaul of the production lines, and also reckon on the successful promotion of new projects. As for converting, the growth of the final demand for films and packaging takes place on the background of decrease in pipe and automotive segments. According to forecasts, in the next two years achieved balance will be maintained, but in the medium term the launch of new facilities will trigger the development, and processors must win in price due to competition for raw materials and PE producers will strengthen their position in world markets".

Source: www.creonenergy.ru

|